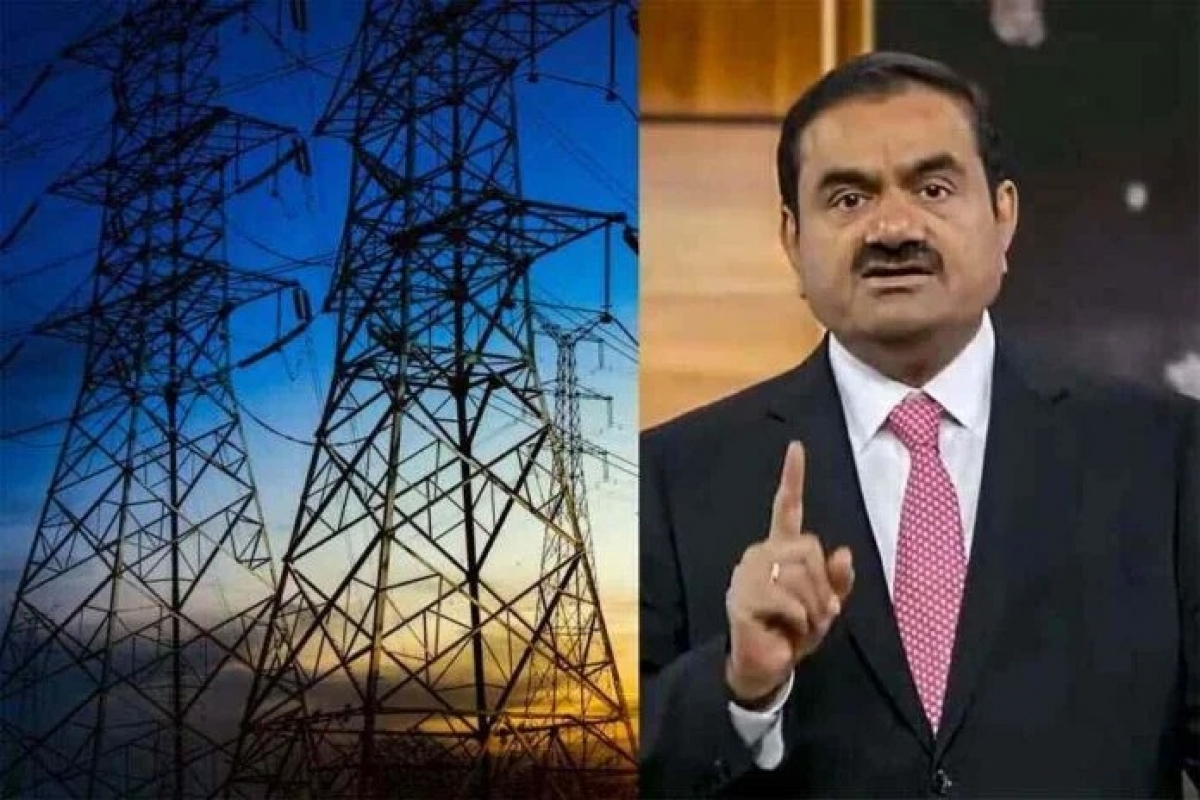

Bangladesh is increasing payments to Adani Power after the Indian conglomerate reduced electricity supplies by half, reportedly due to an unpaid bill of $800 million.

Two senior government officials informed the BBC that they are processing partial payments to Adani, which supplies 10% of the electricity used in Bangladesh.

“We have addressed payment glitches and already issued a $170 million (£143 million) letter of credit to the Adani Group,” a senior official from the Bangladesh Power Development Board told the BBC.

Adani supplies Bangladesh from its 1,600-megawatt coal-fired plant in eastern India. The company has not responded to BBC inquiries regarding its reduced supply to Bangladesh, which is already experiencing regular power shortages.

Officials stated that the company has threatened to suspend all supplies if the outstanding amount is not cleared by 7 November. However, the Bangladesh Power Development Board official expressed confidence, stating they did "not believe it would come to a stage where full supplies are cut off."

Bangladesh officials assured the BBC that they would make payments gradually and regularly and are optimistic about resolving the payment crisis.

“We are shocked and surprised that despite ramping up payments, supplies have been cut. We are ready to repay and will make alternative arrangements, but we will not allow any power producer to hold us hostage or blackmail us,” said Fouzul Kabir Khan, energy adviser to the interim government.

Bangladesh has increased repayments from $35 million in July to $68 million in September and $97 million in October.

The country is already facing heightened power shortages, particularly in rural areas.

Bangladesh has been struggling to generate dollar revenues to cover costly essential imports like electricity, coal, and oil. Foreign currency reserves dwindled during months of student-led protests and political turmoil that led to the ousting of the Sheikh Hasina government in August.

The interim government that succeeded her is seeking an additional $3 billion loan from the International Monetary Fund (IMF), in addition to the existing $4.7 billion bailout package.

Adani’s power deal with Bangladesh, signed in 2015, was one of many under Sheikh Hasina, which the current interim government has described as opaque. A national committee is now reassessing 11 previous deals, including the one with Adani, which has often faced criticism for being expensive.

In addition to Adani Power, other Indian state-owned firms, including NTPC Ltd and PTC India Ltd, also sell power to Bangladesh. Power Development Board officials confirmed that partial payments owed to other Indian power suppliers are also being made.

To address the supply shortfall, Bangladesh is restarting some gas-fired and oil-fired power plants, although experts warn this will increase power costs. With winter approaching, demand on the power grid is expected to ease as air conditioners are turned off.

“Other coal-fired plants are running at 50% capacity, and the country is unable to purchase enough coal due to the dollar crisis, so it is essential to continue sourcing power from Adani. Although it is marginally more expensive than local producers, it is a crucial supply,” said Dr. Ajaj Hossain, an energy expert and retired professor.

Bangladesh is planning to commission its first nuclear power plant in December to diversify its energy mix. Built with Russian assistance, it will cost $12.65 billion, mostly financed by long-term Russian loans. (BBC)